Sunday, July 21, 2013

Saturday, July 20, 2013

What I've Learned from the Short Sales Experts

Today I met with The McClintock Group Palm Beach's most sucessful Short Sale real estate agents to learn more about the short sale process and how and why they are so sucessful in closing almost every transaction. Here's what I've learned from The McClintock Group today.

Whether short sales are a small segment of your business or critical to your survival, you need to know how the process is evolving so that you can beat the high failure rate that continues to plague short-sale offers.

“Lenders have hired more staff, developed more structured escalation policies, and in a few notable cases adopted technology platforms, all intended to improve the quality of their work on short-sale files,” says Joel McClintock “

To the sellers and buyers you serve, being able to masterfully close short sales will make you a hero, a genius, and a saint all rolled into one—a hero for the fearless persistence you show when you hear no (or nothing) from the lender; a genius for being able to understand and explain the changing short-sale guidelines; and a saint for being willing to proceed against the odds.

A Wellington resident found himself on the brink of foreclosure a few years ago after the value of his luxury Home plummeted. He talked with four salespeople before finding Joel McClintock, “Joel took the time to explain the whole process,” writes the Wellington home owner. “He was the only one who said the sale might not go through. He was very up-front about expectations.”

Three months later, the home owner had sold his luxury home in a short sale. “I avoided foreclosure, and my credit looks great,” he writes. He has since bought another home.

A part time Boynton Beach family was on the other side of a short sale. They live in the United States just six months of each year. For several years, they rented from a friend. Another salesperson offered nothing but discouragement. “She kept saying, ‘Don’t buy a short sale. You have to negotiate with the bank, it’s a long wait, and you won’t get it because 30 percent of them don’t go through,’ ” writes the family. When they found a short sale listed by Joel McClintock, we fired the other salesperson. The prospect of dual agency didn’t alarm him: “I’m a shrewd businessman.” he writes.

Three times, the family threatened to pull the plug rather than bring more money to the transaction. As a result, “I found out the bottom-of-the-barrel price the bank would take,” But that price was still higher than the family was willing to pay, so Joel McClitock convinced the seller to put $3,000 into the deal. “It was an emotional roller coaster, but it was pretty amazing because we got the seller to kick money into the pot, we got the bank to drop its price, and he got me to raise my maximum amount,” they write. “The other salesperson couldn’t have come close to this.”

One Destination, Many RoadsWhen you embark on a short sale, the biggest obstacle you’ll face is the lack of a clear, consistent, dependable path. “In Forrest Gump vernacular, short sales are like a box of chocolates,” Apart from the basics—submitting a hardship package and waiting for the bank’s answer—“you have to approach each sale individually and, at the same time, stay on top of a constantly changing landscape,” The McClintock's say.

That starts with an understanding of the federal guidelines that have been created for loan servicers, the entities that collect mortgage payments from home owners and attempt to work out distressed loans through modifications, short sales, deeds-in-lieu of foreclosure, or, if all else fails, foreclosure.

Borrowers who fall within federal guidelines may be able to accomplish a short sale using the Home Affordable Foreclosure Alternatives program. But the HAFA guidelines vary depending on whether the loan is held by Fannie Mae, Freddie Mac, or a private entity, so it’s important to know who owns the loan. Even if they don’t qualify for HAFA, borrowers may still be able to do a short sale—but factors such as the documents required in the hardship package, qualifying criteria, and speed at which a negotiator is assigned will vary. Learning the variations takes time.

After a sale, “I always ask the processor or negotiator, ‘Is there anything we could have done differently?’ ” In this way, we get to know each bank’s particular hang-ups, such as wanting every page of the short-sale package numbered.

As 25-year veteran of the business, “There are still too many lost faxes and inexplicable valuation problems,” Joel McClitock agrees. “There’s also too much ad hoc policy making by inexperienced lender representatives—and too much waiting on hold.”

The McClintock's avoid faxing altogether. “I use certified mail,” Joel McClintock says. “If a document is lost, we can say, ‘You received it at 10:38 a.m.,’ and then it’s mysteriously found. Even if it costs us $20, time is important.”

To curb problems, many servicers are turning to technology platforms that allow you and the servicer to collaborate throughout the short-sale process. The biggest, Equator, was first released as REOTrans in 2003, the platform was expanded about two years ago to handle short sales. It’s used by several major servicers, including Bank of America and Wells Fargo. In general, platforms such as Equator have been lauded for bringing more accountability to the process. But for some practitioners, particularly those with established systems, the change can be daunting. Picking up the phone to communicate an update and making a note in your file won’t suffice. All updates must be recorded in the system.

You’ll have problems if you don’t use the system properly, Michele McClitock says. “Also, beware of a subtle shift some lenders are making from a document-driven to a data-driven process in which you’re expected to do data entry,” Joel says. “It’s one thing to upload a financial statement form that has been completed by the seller and quite a different thing to enter the data on an online form. There’s a risk of introducing an error that could cause a problem in an otherwise approvable short sale.”

If technology is gaining importance, it still plays second fiddle to experience. “It’s a mistake to assume that the lender will place the short sale in the right program, properly apply program guidelines, or understand state-specific regulations,” says Joel McClintock. If you want to achieve the best possible outcome for the owner—a sale with no deficiency judgment—“fair or unfair, you need to be the smartest one in the room,”.

We set clients’ expectations at the outset. “We tell the seller and the buyer’s agent up front that we're going to come down hard on them because we need those documents signed and back the same day,”

We set clients’ expectations at the outset. “We tell the seller and the buyer’s agent up front that we're going to come down hard on them because we need those documents signed and back the same day,”

If you’re working with buyers, you need to assess their readiness. “Not all buyers have the temperament for a short sale,” Joel McClintock says. “Those who require a dependable closing schedule or lack flexibility probably aren’t the best candidates.” You also need to learn as much as you can about the listing and listing agent. Ask: How many short sales have you done? Have you had any hardships? Has an appraisal been done yet? Which lenders are involved?

JD McClintock finds about 10 properties in his buyers’ range, then does a phone interview with each agent. But just asking the questions isn’t useful unless you know why you’re asking, he says. Experience with different lenders will tell you, for example, whether the process will extend beyond your buyers’ time frame or the holder of a second lien will stand in the way of the sale.

Banks Are People, Too

Knowledge gives you bargaining power. “Agents will come in with a $300,000 offer. They’ll be dealing with the lowest-level bank employee, and the BPO will come in at $320,000,” says Joel McClintock. “They have worked on this for months, but they’ll walk away and say, ‘We tried our hardest.’ They don’t know there’s another way to go.”

That other way is to escalate. Joel McClitock has established relationships up the chain of command, enabling his team to cut 30 days off the typical four to seven months it takes to close a short sale, he says.

“There’s an art and science to escalation—when to do it, how to do it,” says Joel McClitock.

“Many real estate agents don’t want to do short sales because they don’t think they can get it done,” JD McClitock says. “Counter back to the banks! You can always provide comparables to support your value. If you’re weak, they’ll run right over you. And ask the seller to contribute. These second mortgages take huge hits; they can’t give you a dime. You have to have a backbone.”

It’s time-intensive work. “At any given time, we are negotiating 50 short sales,” Joel McClitock says. “There are many nights we're in the office going through every file, so we're ready if there’s a request. You have to be organized and know where each file is in the process.”

Deals can turn suddenly. “In one case, we had a cash buyer and bank approval,” Joel McClintock says. “Two days before closing, the bank said it was countering the offer by $15,000.” JD MCClintock jumped in his car and captured photos of comparables to show why the lower offer should stand. “Finally we got it done,” the McClintocks say in harmony. “The negotiators said, ‘You physically took the transaction in hand. Ninety percent of agents wouldn’t do that.’ ”

Joel recently worked with a transferee whose house was $150,000 underwater. His parents had cosigned the loan, and he didn’t want to hurt their credit. “Because he was current, the bank denied him,” says Joel, who reached out to a senior vice president and succeeded in changing the decision.

The point to remember in such a situation is that the bank is not the enemy, Michele McClintock says. “Bank employees" can be inept, but so can agents. They’re human and they’re overwhelmed. You’ll send them paper. They’ll lose it. You’ll send it again. That’s just the way it goes.”

How HAFA Has Helped

In 2009, the U.S. Treasury Department unleashed a torrent of new acronyms for servicers, all under the umbrella of Making Home Affordable. MHA provides guidelines and incentives to lenders to encourage mortgage modifications and to facilitate short sales or deeds-in-lieu of foreclosure in the event a modification isn’t possible or doesn’t work. Lenders start by qualifying borrowers through the Home Affordable Mortgage Program. Those who are eligible for HAMP (based on the size of their mortgage and their financial situation) but don’t qualify for a modification may be considered for the government’s Home Affordable Foreclosure Alternatives program. HAFA offers:

Guidelines for completing short sales and deeds-in-lieu of foreclosure.

Incentives for servicers and investors.

Moving expenses for sellers.

As we ended out conversation they mention that inexperienced short sale agents are welcome to send them referrals. "It's about doing the right thing for people, not a commission" say Michele McClintock.

The McClintock Group be reached at 561-331-2444 info@TheMcClintockgroup.com

In 2009, the U.S. Treasury Department unleashed a torrent of new acronyms for servicers, all under the umbrella of Making Home Affordable. MHA provides guidelines and incentives to lenders to encourage mortgage modifications and to facilitate short sales or deeds-in-lieu of foreclosure in the event a modification isn’t possible or doesn’t work. Lenders start by qualifying borrowers through the Home Affordable Mortgage Program. Those who are eligible for HAMP (based on the size of their mortgage and their financial situation) but don’t qualify for a modification may be considered for the government’s Home Affordable Foreclosure Alternatives program. HAFA offers:

Guidelines for completing short sales and deeds-in-lieu of foreclosure.

Incentives for servicers and investors.

Moving expenses for sellers.

As we ended out conversation they mention that inexperienced short sale agents are welcome to send them referrals. "It's about doing the right thing for people, not a commission" say Michele McClintock.

The McClintock Group be reached at 561-331-2444 info@TheMcClintockgroup.com

Avoid These Common Seller Mistakes

Now that home price have been rising, and buyers are getting off the sidelines (particularly as interest rates creep up), you may be more inclined to list your home — finally! Just make sure you do it the right way:

Price home to sell

A recent poll shows that 75 percent of homeowners think their agent’s listing price is too low! If you’re trying to cash in on the momentum that’s been building, and you think that a higher price is the answer, think again. It could ultimately slow down the deal! It’s better to price the home in line with comps and generate initial interest and attention. Then, if the market takes it higher in the form of multiple offers, great! But if you overprice it to begin with, you’re setting yourself up for disappointment, as you’ll likely get less than fair market value.

Professional photos sell!

The bottom line is that low-quality photos make bad first impressions. Use only high-quality, high-resolution photos to showcase your house. And more and more people are searching for homes via mobile devices, so make sure your photos look good on a smart phone. In June, 270 million homes were viewed on Zillow Mobile — that’s 104 homes per second.

Choose the right agent

When it comes to selling your home — probably the most expensive thing you own — some sellers will hire a friend, a relative who does real estate part time or the agent who is asking for the lowest commission rate. Don’t be foolish. It’s really important that you go with someone who really cares about the transaction, knows how to attract qualified buyers, is a skilled negotiator and understands the complexities of contracts and paperwork. To find the best agent ask me, I'll only tell about the best!

Consider early offers

Once a property is marketed, it typically gets attention right away — in the first few weeks! Eager buyers, weary of looking at the same old listings, will likely pounce, and perhaps even make an offer right away if your house meets their criteria. Don’t be spooked by early bids, hold out for better offers or second guess yourself, wondering if you should have asked for more. So long as the early offer comes in near the asking price, your property was priced correctly. Entertain the offer — even if comes as a total shock/surprise — and take it seriously. More often than not, that first offer turns out to the best one.

Price home to sell

A recent poll shows that 75 percent of homeowners think their agent’s listing price is too low! If you’re trying to cash in on the momentum that’s been building, and you think that a higher price is the answer, think again. It could ultimately slow down the deal! It’s better to price the home in line with comps and generate initial interest and attention. Then, if the market takes it higher in the form of multiple offers, great! But if you overprice it to begin with, you’re setting yourself up for disappointment, as you’ll likely get less than fair market value.

Think: Web appeal

Don’t make the mistake of glamming up your home before the open house. Rather, do it right before you post your listing online, as that’s where 90 percent of buyers start their search — on the Web! — and if they don’t like what they initially see, it’s onto the next house, no questions asked.

Don’t make the mistake of glamming up your home before the open house. Rather, do it right before you post your listing online, as that’s where 90 percent of buyers start their search — on the Web! — and if they don’t like what they initially see, it’s onto the next house, no questions asked.

Professional photos sell!

The bottom line is that low-quality photos make bad first impressions. Use only high-quality, high-resolution photos to showcase your house. And more and more people are searching for homes via mobile devices, so make sure your photos look good on a smart phone. In June, 270 million homes were viewed on Zillow Mobile — that’s 104 homes per second.

Choose the right agent

When it comes to selling your home — probably the most expensive thing you own — some sellers will hire a friend, a relative who does real estate part time or the agent who is asking for the lowest commission rate. Don’t be foolish. It’s really important that you go with someone who really cares about the transaction, knows how to attract qualified buyers, is a skilled negotiator and understands the complexities of contracts and paperwork. To find the best agent ask me, I'll only tell about the best!

Consider early offers

Once a property is marketed, it typically gets attention right away — in the first few weeks! Eager buyers, weary of looking at the same old listings, will likely pounce, and perhaps even make an offer right away if your house meets their criteria. Don’t be spooked by early bids, hold out for better offers or second guess yourself, wondering if you should have asked for more. So long as the early offer comes in near the asking price, your property was priced correctly. Entertain the offer — even if comes as a total shock/surprise — and take it seriously. More often than not, that first offer turns out to the best one.

561-444-8860

Hey Agents, Here’s Why You Should Put The Phone Down

Real estate can easily turn into a 24/7 business. Amidst buyer and seller frenzy, how can real estate agents maintain work/life balance?

Easy. Just don’t answer your phone.

Phone driving you crazy? Maybe you should stop answering it, real estate agents.

Now before your hackles and eyebrows rise, realize that we’re simply talking about setting phone limits. You don’t want to turn into “that agent” who never answers the phone or returns emails.

But you do need to stop:

Answering your phone every time it rings

Replying to every text, email and social media alert immediately

Panicking every time you misplace your phone

…and here’s why:

You need to be at your best with every call.

Nobody wants a burned out, frustrated agent on the other end of the line who can only say ‘I can’t talk right now.’

Imagine talking to your client. On the other end of the line, you hear three background conversations, horns honking, a television blaring and a toddler screaming.

Easy. Just don’t answer your phone.

Phone driving you crazy? Maybe you should stop answering it, real estate agents.

Now before your hackles and eyebrows rise, realize that we’re simply talking about setting phone limits. You don’t want to turn into “that agent” who never answers the phone or returns emails.

But you do need to stop:

Answering your phone every time it rings

Replying to every text, email and social media alert immediately

Panicking every time you misplace your phone

…and here’s why:

You need to be at your best with every call.

Nobody wants a burned out, frustrated agent on the other end of the line who can only say ‘I can’t talk right now.’

Imagine talking to your client. On the other end of the line, you hear three background conversations, horns honking, a television blaring and a toddler screaming.

This is not a productive conversation.

There’s nothing worse for a professional relationship than failure to give proper attention. If your clients feel they’re getting one-quarter of your attention with every call, you’re doing something wrong.

If you’re in the middle of something, don’t answer your phone. Check your voicemail as soon as possible, and reply when your full attention is at the ready. And remember the power (and convenience) of text messages! Send a quick text if an urgent reply is needed and appropriate.

When in doubt, regroup. One focused, quiet call is better than ten hectic, disjointed conversations.

Clients will appreciate your sense of family.

Let clients know this up front. They admire honesty and work ethic. They know that you work extremely hard for them during the non-family hours.

Your clients have a family life, too. And unless they’re totally selfish, they’ll understand and appreciate your need for scheduled family time.

And if they’re totally selfish, you may not want them as clients, anyway.

You HAVE to set boundaries.

No one gets to the point when they can turn it off. One must manage clients’ expectations. Set limits (working hours) and stick to it. If anyone doesn’t respect you professionalism, you don’t need them as a client.

You can’t assume that clients have reasonable expectations when it comes to your working hours. Your habits tell your clients what to expect. If you routinely answer the phone at 3 a.m., your clients will continue to call at 3 a.m.

So don’t answer the phone at 3 a.m.

Start any professional relationship with clearly defined phone-answering protocol. Explain how and when clients can best reach you.

Example: “My phone is on from 7 a.m. to 8 p.m. every day. If you need something outside of those hours, please leave me a message or send me a text and I’ll reply as soon as possible.”

Most clients are reasonable and understand boundaries. You just have to explain what those boundaries are.

You need to recharge.

It will make you more focused, less cranky and more effective. Its a good business decision. You don’t expect to talk to your other professional service careers 24/7. Aligning expectations is a primary skill.

There’s a reason we live in homes and not in cubicles.

You charge your phone every night. Don’t forget to do the same for your life and your relationships. Everyone needs to rest and recharge including real estate agents.

You only live once. Do it right.

Nothing is more important than your family. Enjoy your family while they’re here.

Personal relationships are strengthened and weakened in tiny, seemingly unimportant moments:

Over a family meal

During a backyard wiffle ball tournament

On a bike ride with a close friend

Don’t skim those moments from your life to focus more on business. There are always exceptions, of course, but don’t let those exceptions become the rule.

Let this blog post be your jolt. Enjoy your family and friends. The satisfaction and joy that result from good personal relationships will seep into every aspect of your life, including your business.

So do yourself, your loved ones and your business a favor: Don’t answer that phone.

Want even more time? Hire a Professional Transaction Coordinator, such as myself and free yourself. You'll be glad you did.

That's What Real Estate on Higher Level is All About.

There’s nothing worse for a professional relationship than failure to give proper attention. If your clients feel they’re getting one-quarter of your attention with every call, you’re doing something wrong.

If you’re in the middle of something, don’t answer your phone. Check your voicemail as soon as possible, and reply when your full attention is at the ready. And remember the power (and convenience) of text messages! Send a quick text if an urgent reply is needed and appropriate.

When in doubt, regroup. One focused, quiet call is better than ten hectic, disjointed conversations.

Clients will appreciate your sense of family.

Let clients know this up front. They admire honesty and work ethic. They know that you work extremely hard for them during the non-family hours.

Your clients have a family life, too. And unless they’re totally selfish, they’ll understand and appreciate your need for scheduled family time.

And if they’re totally selfish, you may not want them as clients, anyway.

You HAVE to set boundaries.

No one gets to the point when they can turn it off. One must manage clients’ expectations. Set limits (working hours) and stick to it. If anyone doesn’t respect you professionalism, you don’t need them as a client.

You can’t assume that clients have reasonable expectations when it comes to your working hours. Your habits tell your clients what to expect. If you routinely answer the phone at 3 a.m., your clients will continue to call at 3 a.m.

So don’t answer the phone at 3 a.m.

Start any professional relationship with clearly defined phone-answering protocol. Explain how and when clients can best reach you.

Example: “My phone is on from 7 a.m. to 8 p.m. every day. If you need something outside of those hours, please leave me a message or send me a text and I’ll reply as soon as possible.”

Most clients are reasonable and understand boundaries. You just have to explain what those boundaries are.

You need to recharge.

It will make you more focused, less cranky and more effective. Its a good business decision. You don’t expect to talk to your other professional service careers 24/7. Aligning expectations is a primary skill.

There’s a reason we live in homes and not in cubicles.

You charge your phone every night. Don’t forget to do the same for your life and your relationships. Everyone needs to rest and recharge including real estate agents.

You only live once. Do it right.

Nothing is more important than your family. Enjoy your family while they’re here.

Personal relationships are strengthened and weakened in tiny, seemingly unimportant moments:

Over a family meal

During a backyard wiffle ball tournament

On a bike ride with a close friend

Don’t skim those moments from your life to focus more on business. There are always exceptions, of course, but don’t let those exceptions become the rule.

Let this blog post be your jolt. Enjoy your family and friends. The satisfaction and joy that result from good personal relationships will seep into every aspect of your life, including your business.

So do yourself, your loved ones and your business a favor: Don’t answer that phone.

Want even more time? Hire a Professional Transaction Coordinator, such as myself and free yourself. You'll be glad you did.

That's What Real Estate on Higher Level is All About.

10 Bath and Kitchen Trends to Watch This Year

Shades of gray, quartz finishes, and energy efficiency are all growing in popularity in kitchens and baths this year, according to a National Kitchen & Bath Association survey of 2013 design trends.

NKBA reports that home owners this year are spending, on average, $47,308 on making over their kitchens, and $18,538 in bathrooms.

Here are the top 10 trends emerging from this year’s report for kitchens and bathrooms:

1. Gray color schemes

2. Quartz finishes for counter surfaces

3. Transitional styles — a blend of traditional and contemporary

4. White painted cabinetry in the kitchen

5. Glass blacksplashes

6. LED lighting

7. Touch-activated faucets

8. Satin-nickel finishes in kitchens

9. Ceramic or porcelain tile flooring

10. Undermount sinks in bathrooms

By Melissa Dittmann Tracey, REALTOR(R) Magazine

NKBA reports that home owners this year are spending, on average, $47,308 on making over their kitchens, and $18,538 in bathrooms.

Here are the top 10 trends emerging from this year’s report for kitchens and bathrooms:

1. Gray color schemes

2. Quartz finishes for counter surfaces

3. Transitional styles — a blend of traditional and contemporary

4. White painted cabinetry in the kitchen

5. Glass blacksplashes

6. LED lighting

7. Touch-activated faucets

8. Satin-nickel finishes in kitchens

9. Ceramic or porcelain tile flooring

10. Undermount sinks in bathrooms

By Melissa Dittmann Tracey, REALTOR(R) Magazine

Friday, July 19, 2013

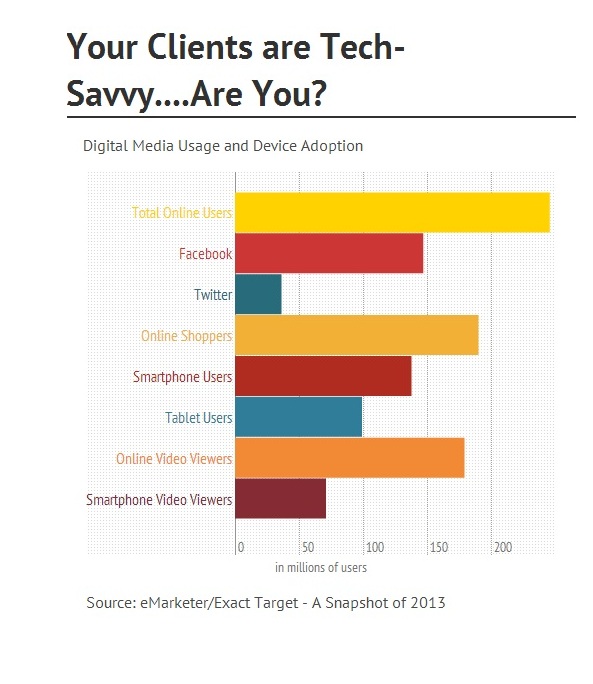

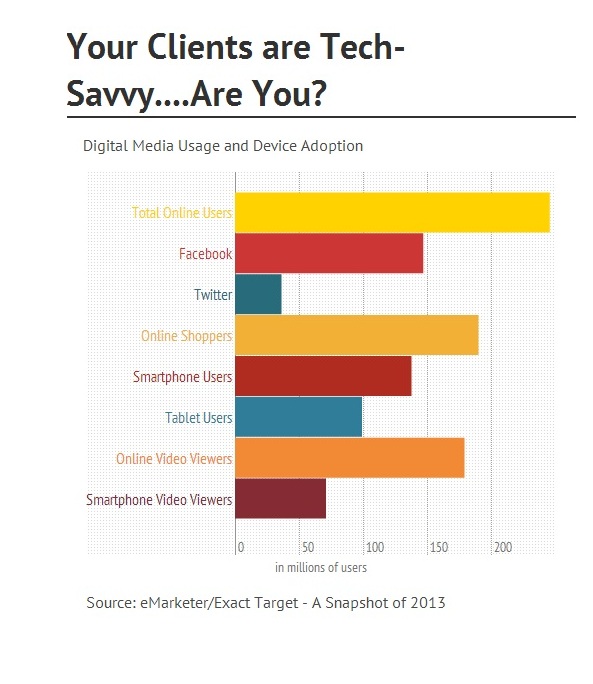

Your Clients are Tech Savvy... Are you? Consumers are 73% more likely to list their home with an agent that uses video.

Video may not be new technology, but the propensity for consumers to watch, learn from and shop by watching videos is a relatively recent trend. More importantly it's a trend you have to understand and exploit in your real estate marketing plan. eMarketer and Exact Target did a recent study that shows large audiences across social, mobile and video destinations.

Your current real estate marketing plan probably has the basics covered — your website, LinkedIn, and of course for your listings sites like Realtor.com, Trulia, Zillow and social media sites like Facebook. But if you really want to be forward looking, differentiate yourself from the pack, and reach buyers and sellers where they live, you should get out the video camera and get on YouTube. 1 billion people visit YouTube each month worldwide, resulting in 1 billion daily views on mobile devices!

Why? Because buyers know instinctively what YouTube announced at the 2013 Consumer Electronics Show: in the near future, 90% of all web visitors will be watching video. Folks are using every possible type of medium to learn about prospective listings and agents, including blogs, photos and videos. Not surprisingly, they want you to use every tool in your digital toolkit to market to them and to promote their listings.

We see three main types of videos in the real estate landscape:

Videos that feature listings. These are the videos you're more than likely doing already. Video of homes you're listing and/or neighborhoods you specialize in. No longer innovative, this approach is really required for any realtor.

Video tours that build brand whether it's for your agency or for you.

Videos that educate realtors. A quick YouTube search will bring you a wealth of videos from industry pundits so that you can benefit from the knowledge and skills of your colleagues around the globe. Sites like BiggerPocekts and Active Rain also provide a wealth of knowledge from agents who are in the trenches everyday.

*Source: National Association of Realtors (NAR) via InMan News.

So you know where they're spending their time online...

but how do you reach them?

Your current real estate marketing plan probably has the basics covered — your website, LinkedIn, and of course for your listings sites like Realtor.com, Trulia, Zillow and social media sites like Facebook. But if you really want to be forward looking, differentiate yourself from the pack, and reach buyers and sellers where they live, you should get out the video camera and get on YouTube. 1 billion people visit YouTube each month worldwide, resulting in 1 billion daily views on mobile devices!

Consumers are 73% more likely to list their home

with an agent that uses video.*

Why? Because buyers know instinctively what YouTube announced at the 2013 Consumer Electronics Show: in the near future, 90% of all web visitors will be watching video. Folks are using every possible type of medium to learn about prospective listings and agents, including blogs, photos and videos. Not surprisingly, they want you to use every tool in your digital toolkit to market to them and to promote their listings.

We see three main types of videos in the real estate landscape:

Videos that feature listings. These are the videos you're more than likely doing already. Video of homes you're listing and/or neighborhoods you specialize in. No longer innovative, this approach is really required for any realtor.

Video tours that build brand whether it's for your agency or for you.

Videos that educate realtors. A quick YouTube search will bring you a wealth of videos from industry pundits so that you can benefit from the knowledge and skills of your colleagues around the globe. Sites like BiggerPocekts and Active Rain also provide a wealth of knowledge from agents who are in the trenches everyday.

*Source: National Association of Realtors (NAR) via InMan News.

3 tips for a successful property seller closing- Christine Matus PA, Palm Beach Transaction Coordinator

1. Check the Property Appraiser’s website (PAPA) before taking the listing. Carefully review the deed and make sure that the individuals named on the deed are those who are signing the listing paperwork. Don't rely on who is listed as the owner. Open and read the deed.

2. Prepare all your required disclosures when you take the listing and attach them to the MLS. It’s a great time saver when these forms are included with the offer. Make sure to note the disclosures are attached in the broker remarks.

3. Calendar events and important dates on the day of acceptance. Track your important events and dates in your transaction. Add the date of contingency removal, the date disclosures are due to the buyer, the date of acceptance, deposits due and all other important dates. Be mindful of the calendar so that your client is always protected throughout the transaction.

2. Prepare all your required disclosures when you take the listing and attach them to the MLS. It’s a great time saver when these forms are included with the offer. Make sure to note the disclosures are attached in the broker remarks.

3. Calendar events and important dates on the day of acceptance. Track your important events and dates in your transaction. Add the date of contingency removal, the date disclosures are due to the buyer, the date of acceptance, deposits due and all other important dates. Be mindful of the calendar so that your client is always protected throughout the transaction.

Or you can make it easy and hire a professional transaction coordinator (Closing Coordinator) such as myself, and not worry about any of it. I have you covered!

561-444-8860

Thursday, July 18, 2013

Tuesday, July 2, 2013

Monday, July 1, 2013

Sunday, June 30, 2013

I take Transaction Coordination very seriously!

Whether you are full time, part time, some time agent, your time is valuable. In an ever changing real estate market, leveraging your time effectively is not something you should do, but what you must do if you want to succeed.

Enter Christine Matus PA Real Estate Solutions: I am ready to handle your transaction coordinator needs; saving time & money.

It couldn't be easier. Let me chase the paper and make the calls so you can focus on your clients; while you go out and list & sell!

Remember, no matter how many deals you close a month; if you are spending time focusing on activities that don't have the potential to produce a sale, then you are losing time and money needlessly.

For example, you can spend 20+ hours on pending transactions scheduling appointments, chasing down signatures, copying, faxing, emailing' etc..

Or you can outsource your file management for that transaction & use that 20+ hours to prospect for more business and give your clients additional time. Which is going to give you a better opportunity to make a sale?

My mission at Christine Matus PA Real Estate Solutions is clear: To deliver the highest level of customer service while assisting agents and their clients to a successful closing. I am committed to working with you on all of your transaction coordination needs to provide the solutions you need at a reasonable price. And most importantly, I partner with you to improve your efficiency and productivity, which ultimately increases your bottom line.

561-444-8860

Friday, June 28, 2013

Associations vote to dissolve Florida-based Regional MLS

The board of directors of Jupiter, Fla.-based Regional Multiple Listing Service Inc. has voted to dissolve the 11,000-member MLS following the settlement of a lawsuit filed by one of its shareholder associations.

Regional MLS members are now receiving all MLS services directly through their respective associations: the Realtors Association of the Palm Beaches, the Jupiter-Tequesta-Hobe Sound Association of Realtors, and the Realtors Association of St. Lucie.

- See more at: inman.com

Wednesday, June 26, 2013

Are you working real estate or is real estate working you?

Are you managing your time effectively?

Are you able to devote your time to client care, client retention, and building new business?

As an independent Transaction Coordinator I have taken the opportunity to meet a need in the current real estate market. I can meet your needs for strong professional support by applying my background, knowledge and experience in real estate transactions to help YOU. You can focus on building your business and be assured that the details on your transaction are being attended to and in good hands. Previously licensed in New York for 10 years and currently in Florida. I have 17 years experience in real estate. I have been affiliated with Keller Williams Realty for the last 4 years.

My strong knowledge of the principles, practices, and procedures involved in real estate transactions enable me to provide constructive feedback and guidance to agents regarding their contracts and transactions. I possess a strong work ethic and excellent communication, interpersonal and organizational skills. I am organized, detail-oriented, and enjoy working with others as a team to attain and exceed goals. These qualities were influential in building my career and my outstanding reputation with agents from other brokerages and service providers.

I take new tasks and challenges head-on. I do research, collaborate with others, and develop new forms and systems to ensure we are representing our clients, agents, and brokerage with the highest standards. Please contact me and discuss how my freeing up some precious time on your transactions can actually improve your business, allow you to spend more quality time with your family, or focus on other pursuits.

Are you able to devote your time to client care, client retention, and building new business?

Welcome to Real Estate Solutions! My name is Christine Matus and I am professional Real Estate Transaction Coordinator. I focus on ensuring the file is complete with all statutory and contractually obligated documents. I point out unclear areas of the contract and areas which might need to be “tightened up” so you can better protect yourself and your client. My strengths, diligence and knowledge of real estate contracts and the applicable laws that affect them, these coupled with attention to detail, enable me to be a strong asset to your business plan.

As an independent Transaction Coordinator I have taken the opportunity to meet a need in the current real estate market. I can meet your needs for strong professional support by applying my background, knowledge and experience in real estate transactions to help YOU. You can focus on building your business and be assured that the details on your transaction are being attended to and in good hands. Previously licensed in New York for 10 years and currently in Florida. I have 17 years experience in real estate. I have been affiliated with Keller Williams Realty for the last 4 years.

Keeping my word and safeguarding the interests of all parties have defined my real estate career. I have a high standard of care and integrity and am a driven person who enjoys learning and exceeding at challenges. I am your ideal Transaction Coordinator because of my educational and professional experience, aptitudes, and qualities.

My strong knowledge of the principles, practices, and procedures involved in real estate transactions enable me to provide constructive feedback and guidance to agents regarding their contracts and transactions. I possess a strong work ethic and excellent communication, interpersonal and organizational skills. I am organized, detail-oriented, and enjoy working with others as a team to attain and exceed goals. These qualities were influential in building my career and my outstanding reputation with agents from other brokerages and service providers.

I take new tasks and challenges head-on. I do research, collaborate with others, and develop new forms and systems to ensure we are representing our clients, agents, and brokerage with the highest standards. Please contact me and discuss how my freeing up some precious time on your transactions can actually improve your business, allow you to spend more quality time with your family, or focus on other pursuits.

HUGE Assortment of Real Estate Promotional Items

What Are You Looking For?

Apparel, Caps, and Hats - Apparel - Athletic, Apparel - Bed and Bath, ...

Automotive Accessories - Air Fresheners, Alarms and Protective Devices, ...

Awards and Recognition - Acrylic Awards, Alumni Items, ...

Backpacks, Bags, and Totes - Backpacks, Bag Accessories, Bags

Badges, Buttons, Magnets, and Stickers - Badge Accessories, Badge Holders, ...

Business, Desktop, and Office - Acrylic Displays, Acrylic Sign Holders, ...

Calendars - Adhesive Calendars, Calendar Accessories, ...

Clocks and Watches - Alarm Clocks, Analog Clocks, ...

Computer Accessories - CD-ROMs, Computer Accessories, ...

Diaries, Journals, and Notepads - Book Accessories, Diaries - Desk, ...

Drinkware - Barware, Beverage Accessories, ...

Electronics - Audio Products, Battery-operated Products, ...

Fitness, Health, and Safety - Aromatherapy, Back Braces, Bandages, ...

Food and Edibles - Beverage - Private Label, ...

Games and Novelties - Animal Theme Products, Animals - Stuffed, ...

Home and Housewares - Adhesives, Albums, Anti-Bacterial, ...

Jewelry - Bracelets, Charms, Crowns, Cuff Accessories, ...

Luggage and Travel -Airline Accessories, Luggage, ...

Outdoors, Sports, and Leisure - Balloon Accessories, Balloons, ...

Pocket and Purse Accessories - Coin Pouches, Coins, Credit Card Accessories, ...

Tools - Duct Tape, Levels, Metric Accessories, ...

Writing Instruments - Ballpoint Pens, Chalk and Crayons, ... & So Much More!

Automotive Accessories - Air Fresheners, Alarms and Protective Devices, ...

Awards and Recognition - Acrylic Awards, Alumni Items, ...

Backpacks, Bags, and Totes - Backpacks, Bag Accessories, Bags

Badges, Buttons, Magnets, and Stickers - Badge Accessories, Badge Holders, ...

Business, Desktop, and Office - Acrylic Displays, Acrylic Sign Holders, ...

Calendars - Adhesive Calendars, Calendar Accessories, ...

Clocks and Watches - Alarm Clocks, Analog Clocks, ...

Computer Accessories - CD-ROMs, Computer Accessories, ...

Diaries, Journals, and Notepads - Book Accessories, Diaries - Desk, ...

Drinkware - Barware, Beverage Accessories, ...

Electronics - Audio Products, Battery-operated Products, ...

Fitness, Health, and Safety - Aromatherapy, Back Braces, Bandages, ...

Food and Edibles - Beverage - Private Label, ...

Games and Novelties - Animal Theme Products, Animals - Stuffed, ...

Home and Housewares - Adhesives, Albums, Anti-Bacterial, ...

Jewelry - Bracelets, Charms, Crowns, Cuff Accessories, ...

Luggage and Travel -Airline Accessories, Luggage, ...

Outdoors, Sports, and Leisure - Balloon Accessories, Balloons, ...

Pocket and Purse Accessories - Coin Pouches, Coins, Credit Card Accessories, ...

Tools - Duct Tape, Levels, Metric Accessories, ...

Writing Instruments - Ballpoint Pens, Chalk and Crayons, ... & So Much More!

Tuesday, June 25, 2013

Monday, June 24, 2013

"Time is of the Essence" when buying or selling a home in Palm Beach

You may have noticed the phrase "time is of the essence"

... But what does that mean?

It means that deadlines MUST be met ... Or ELSE!

... Or else what?

That depends upon the contract clause. If your agreement says you must complete an inspection by a set date and you don't do it, it means you've accepted the house As-Is.

If the agreement says you must let the seller know about items of concern within a set number of days after an inspection, it means that you have only that many days to back out of the contract or re-negotiate based on the inspection.

The same is true for other contingencies. They must be removed by the specified date or the contingency evaporates.

This can be important to a buyer because depending upon the contingency, it can mean loss of earnest money.

If you present an offer to a seller (or a counter-offer to a buyer) and give him or her 3 days to respond, it means non-response in that time releases you from the offer.

Even the closing date has an "or else." If the buyer doesn't close on the specified date, the seller is no longer obligated to complete the transaction.

If a loan commitment contingency and it has a due date, Seller can be released from the contract. This is important to know!

Of course, when both parties agree, these dates can be changed. But be aware that the other party is never obligated to grant an extension of time.

"Time is of the Essence"

This information is not a substitute for the advice of an attorney.

I am not permitted to engage in the practice of law.

ChristineMatus.com

561-444-8860

Subscribe to:

Posts (Atom)